In today’s digital age, financial literacy is more critical than ever, especially for teenagers and young adults. The early years of one’s financial journey lay the foundation for future financial success or struggles. In this article, we’ll delve into the five biggest money mistakes that many teenagers make and how avoiding them can set you on a path to financial prosperity.

Mistake 1: Delaying Investments

The Power of Compounding

One of the most significant advantages of starting early is harnessing the power of compounding. Compounding essentially means that your money earns money over time, and the earlier you begin, the greater your financial gains. Imagine this: your investments growing exponentially rather than linearly. This concept is the essence of compounding returns.

But here’s the catch: it’s not just about the money. Starting early also builds the habit of investing. Many young individuals hesitate to invest because they lack knowledge or fear losing money. By beginning your investment journey as a teenager, you not only accumulate wealth but also gain valuable experience and confidence.

Mistake 2: Spending on Low-Value Items

The Law of Diminishing Returns

A common mistake among teenagers is spending money on items that provide little long-term value. This includes impulsively buying gadgets, fashion items, or other unnecessary luxuries. To avoid this pitfall, consider the law of diminishing returns.

This law suggests that as you acquire more of a particular item, the incremental happiness or utility derived from each additional unit decreases. In practical terms, it means that upgrading from a basic model to a more expensive one may not significantly improve your satisfaction.

When contemplating a purchase, ask yourself if the item will genuinely enhance your life or if it’s just a status symbol. Prioritize investments that yield lasting benefits and experiences over fleeting material possessions.

Mistake 3: Buying for Status, Not Utility

The Trap of Conspicuous Consumption

Many teenagers fall into the trap of buying things to signal status rather than meeting practical needs. This often leads to regrettable purchases and financial strain. Consider whether you genuinely need an item or if you’re simply drawn to the idea of owning it.

Avoid making purchases solely for the purpose of impressing others. Instead, focus on acquiring assets or experiences that genuinely enrich your life.

Mistake 4: Dealing with Unreliable Sources

The Importance of Due Diligence

Teenagers are often eager to find the best deals, but this enthusiasm can lead to hasty decisions. Be cautious when buying from sources you’re unfamiliar with, especially online marketplaces. Research the product, seller, and reviews before making a purchase.

One common mistake is falling for scams. If a deal seems too good to be true, it probably is. Take your time, verify information, and trust your instincts.

Mistake 5: Undervaluing Your Time

Recognizing the Value of Your Efforts

As a teenager, you might engage in various activities to earn money, like part-time jobs or freelancing. While it’s essential to save, it’s equally crucial to recognize the value of your time.

Consider setting a realistic hourly rate for your work, even if it’s not a traditional job. This will help you prioritize high-earning activities over low-paying ones. Think about the opportunity cost – what else could you be doing with your time to earn more?

Conclusion

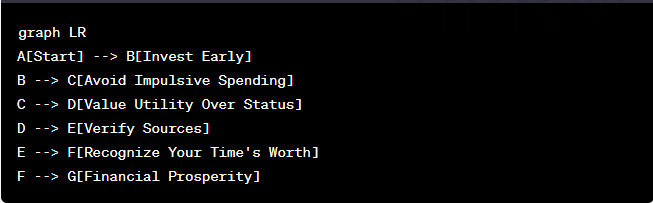

In summary, avoiding these five money mistakes as a teenager can significantly impact your financial future. Start investing early to benefit from compounding returns and build valuable experience. Be mindful of your spending, focusing on items that provide lasting value. Avoid purchasing solely for status and be cautious when dealing with unfamiliar sources. Lastly, recognize the value of your time and prioritize activities that yield higher returns.

By applying these principles, teenagers can lay a strong financial foundation, setting them on a path to financial security and success in adulthood.

Remember: Financial literacy is a lifelong journey, and the earlier you start, the brighter your financial future will be.

Financial journey

Outranking the competition in the realm of financial advice requires delivering comprehensive, insightful content. This article offers valuable insights and practical advice that can help teenagers make informed financial decisions, setting them on the path to financial success.