How to Manage a Portfolio in Tough Times

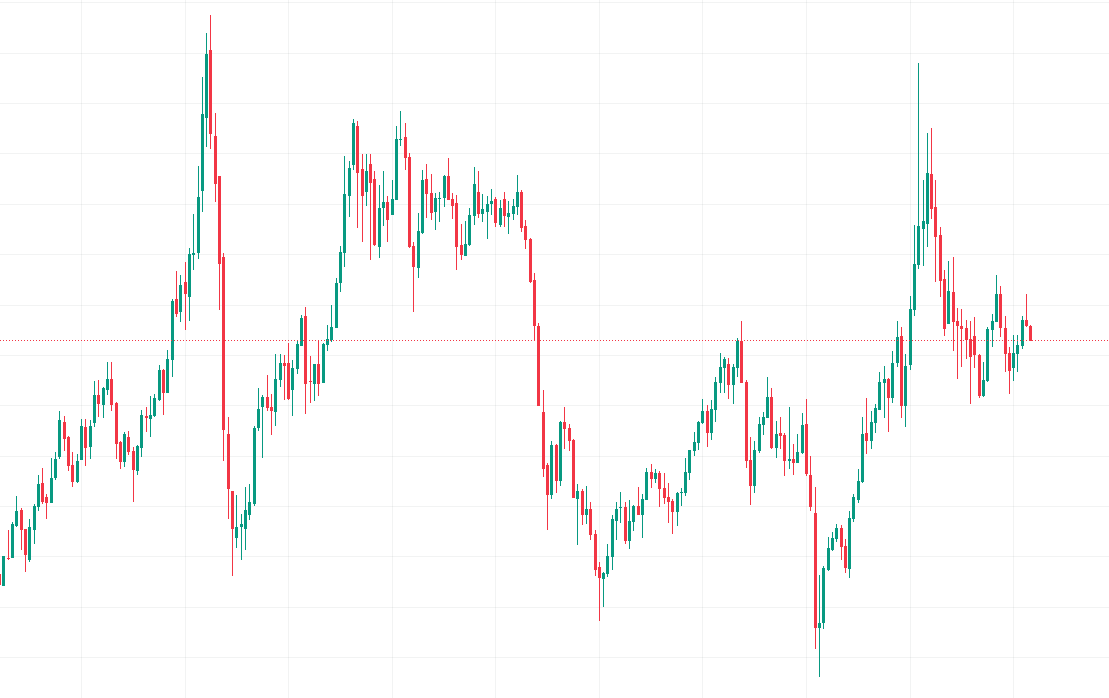

In times of market downturns, the importance of effective portfolio management cannot be overstated. Economic turbulence and financial instability often lead to heightened volatility and increased risk, making it imperative for investors to adopt strategies that safeguard their investments and minimize potential losses. A well-managed portfolio not only helps in mitigating the adverse effects of … Read more