In the world of investing, the term “multibagger” is often used to describe a golden ticket – a stock that multiplies in value many times over. But what exactly is a multibagger stock, and how can you identify one? Let’s delve into it.

What is a Multibagger Stock?

A multibagger stock is an equity stock that gives returns several times its cost to the investor. This term is most commonly used in the context of stock markets and is often used by analysts and traders. The term was coined by Peter Lynch, a renowned investor and fund manager, in his book ‘One Up on Wall Street’.

Characteristics of Multibagger Stocks

While there’s no surefire way to identify a multibagger stock, they often share some common characteristics:

- Strong Fundamentals: Multibagger stocks often belong to companies with strong fundamentals, including robust financial health, good corporate governance, and a scalable business model.

- Competitive Advantage: These companies usually have a unique product or service, or a distinct competitive advantage in their sector.

- Growth Potential: Multibaggers are often found in industries with high growth potential. They are typically companies that are poised to benefit from an industry or economic trend.

How to Spot a Multibagger Stock?

Identifying a multibagger requires a mix of fundamental analysis, patience, and a bit of luck. Here are some steps to guide you:

- Research: Understand the company’s business model, industry, competition, and growth prospects.

- Financial Analysis: Look at the company’s financials. Healthy balance sheets, consistent revenue growth, and good profit margins are positive signs.

- Management Quality: A competent and honest management team is crucial for the company’s success.

- Patience: Multibaggers don’t happen overnight. It requires patience to hold onto the stock and let the investment thesis play out.

Risks Involved

Investing in potential multibaggers also comes with its share of risks. The company’s growth story may not play out as expected, or there could be unforeseen industry changes or regulatory hurdles. Therefore, it’s important to diversify your portfolio and not put all your eggs in one basket.

Conclusion

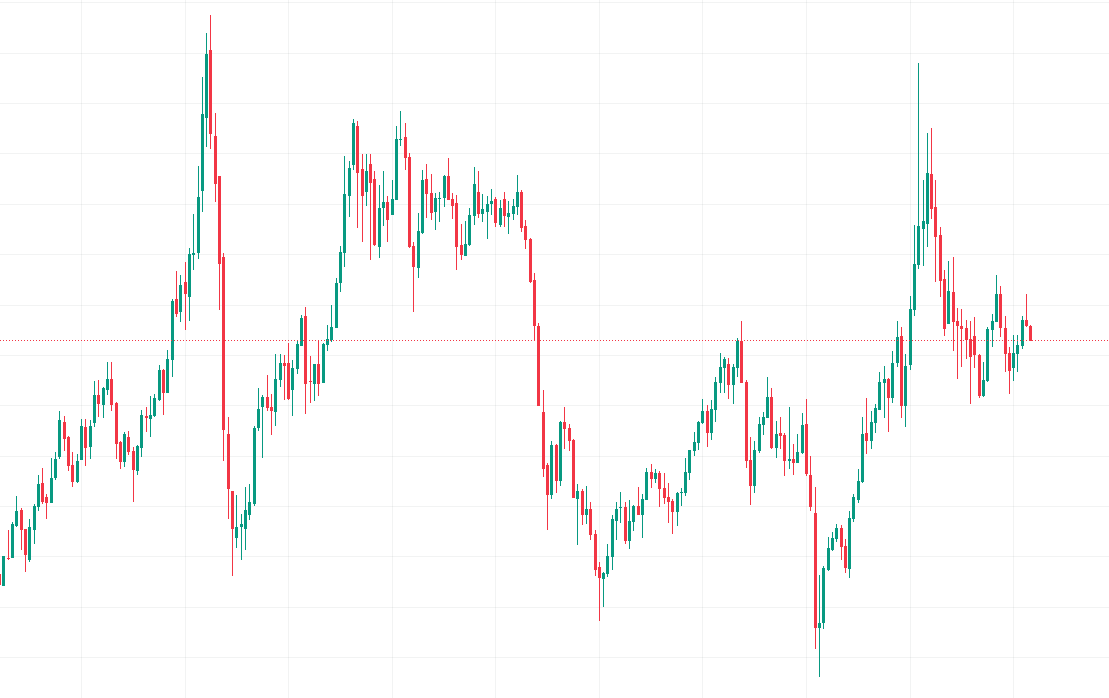

Multibagger stocks can be a game-changer for your investment portfolio, but finding them requires diligent research, patience, and a keen understanding of the market. Remember, the journey to finding a multibagger is often marked with volatility and risk. Therefore, it’s crucial to stay informed, be patient, and maintain a diversified portfolio.

Disclaimer: This blog post is for informational purposes only and should not be taken as investment advice. Always do your own research or consult with a financial advisor before making investment decisions.